Funding Options

Whether you’re a startup or an established business owner, we know business loans are an important tool for your business. We can help.

The only thing standing between small business owners and success is often capital. By applying, we can find the right product to help you meet your business and financial needs. We know applying for a loan is an important decision, our team will be there to help you package and understand your funding options. Our aim is to make sure we provide capital that meets your goals and budget.

- -

How It Works

Prepare and Gather

Know your business goals and needs. Then, gather and review your financials and credit history. Be prepared to share this information during the application process.

Apply and Submit

Review the list of information you need to apply through LiftFund and make sure you have all necessary documentation. Then, apply and submit all of your documents.

Your Decision

We’ll assess your application and documents to make a decision.

Prepare and Gather

Know your business goals and needs. Then, gather and review your financials and credit history. Be prepared to share this information during the application process.

Apply and Submit

Review the list of information you need to apply through LiftFund and make sure you have all necessary documentation. Then, apply and submit all of your documents.

Your Decision

We’ll assess your application and documents to make a decision.

Small Business Loans

You’re ready to grow and strengthen your business with a loan.

Apply now and a team member will review your information and documents to find a LiftFund product that fits your business goals and budget. We provide loans for:

- Commercial Real Estate Purchases

- Equipment

- Inventory

- Leasehold Improvements

- Supplies

- Vehicles

- Working Capital

Whether you have limited credit, collateral or experience, our team will work with you to provide a loan that allows you to build your credit and improve your finances.

LiftFund offers small business loans to entrepreneurs located in the following states: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Missouri, Mississippi, New York, New Mexico, Oklahoma, South Carolina, Tennessee, and Texas.

Small Business Loans

You’re ready to grow and strengthen your business with a loan.

Apply now and a team member will review your information and documents to find a LiftFund product that fits your business goals and budget. We provide loans for:

- Commercial Real Estate Purchases

- Equipment

- Inventory

- Leasehold Improvements

- Supplies

- Vehicles

- Working Capital

Whether you have limited credit, collateral or experience, our team will work with you to provide a loan that allows you to build your credit and improve your finances.

LiftFund offers small business loans to entrepreneurs located in the following states: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Missouri, Mississippi, New York, New Mexico, Oklahoma, South Carolina, Tennessee, and Texas.

Helpful tools and resources

Success Stories

Special Programs

We’re here to help you strengthen your business.

Our special programs, in collaboration with our generous partners, are designed to provide you access to flexible funding and special rates.

Learn more about our special funding options and apply today!

Loan Programs

SMALL BUSINESS GRANT PROGRAMS

Success Stories

Special Programs

We’re here to help you strengthen your business.

Our special programs, in collaboration with our generous partners, are designed to provide you access to flexible funding and special rates.

Learn more about our special funding options and apply today!

Loan Programs

Small business grant programs

SBA 7a Community Advantage

Finding traditional business loans isn’t easy. That’s especially true if you’re a startup, in a risky business industry or both.

You need capital that can support you — a loan that can help you grow your business so you can prove your success and qualify for a bank loan. If this describes you, the SBA 7A Community Advantage loan program may be the right fit. We’re a partner with SBA and the program funds startups and existing businesses, startup costs, operating expenses, business acquisition, refinancing business debt, tenant improvements, working capital, equipment purchases and more.

Terms: 7-10 year term; 25 year term for real estate; Prime + (2.75% to 6%); Variable rate (based on Wall Street)

- Available for start-up and existing businesses;

- SBA guarantee allows us to provide financing;

- Complimentary consultation;

- No prepayment penalties;

- Cash flow must be sufficient for payments;

- Owner Injection: 20% startups, 20% business acquisitions;

- Projections reviewed for businesses affected by COVID19;

LiftFund offers the Community Advantage loan to small businesses located in the following states: Alabama, Arkansas, California, Florida, Georgia, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, New York, Oklahoma, South Carolina, Tennessee, and Texas.

SBA 7a Community Advantage

Finding traditional business loans isn’t easy. That’s especially true if you’re a startup, in a risky business industry or both.

You need capital that can support you — a loan that can help you grow your business so you can prove your success and qualify for a bank loan. If this describes you, the SBA 7A Community Advantage loan program may be the right fit. We’re a partner with SBA and the program funds startups and existing businesses, startup costs, operating expenses, business acquisition, refinancing business debt, tenant improvements, working capital, equipment purchases and more.

Terms: 7-10 year term; 25 year term for real estate; Prime + (2.75% to 6%); Variable rate (based on Wall Street)

- Available for start-up and existing businesses;

- SBA guarantee allows us to provide financing;

- Complimentary consultation;

- No prepayment penalties;

- Cash flow must be sufficient for payments;

- Owner Injection: 20% startups, 20% business acquisitions;

- Projections reviewed for businesses affected by COVID19;

LiftFund offers the Community Advantage loan to small businesses located in the following states: Alabama, Arkansas, California, Florida, Georgia, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, New York, Oklahoma, South Carolina, Tennessee, and Texas.

Helpful tools and resources

Success Stories

SBA 504 Loans

LiftFund can help small business owners acquire real estate and equipment they need to grow their businesses.

The SBA created the 504 loan program to help entrepreneurs finance commercial real estate and equipment for their businesses. Businesses use these loans to finance fixed asset acquisitions such as:

- Purchases of existing buildings

- Land purchases and improvements

- New facility construction

- Existing facility modernizations,

- renovations, and conversions

- Long-term machinery purchases

- Some furniture and fixtures

Businesses in operation for 2 or more years can also use 504 loans to refinance existing debt that meets the following criteria:

- A non-federal loan

- Outstanding for 2 or more years

- Current on all payments for the last 12 months

- It was used originally (85% or more) to finance eligible 504 uses (see above)

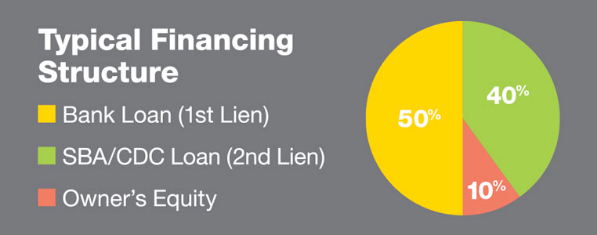

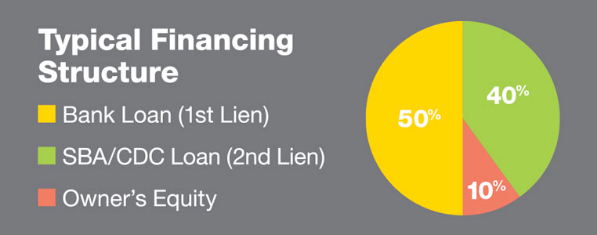

The graph to the right shows how LiftFund partners with a participating lender (typically a bank) to finance part of the project. Most projects require a 50-40-10 split. However, businesses and/or projects considered “special purpose” require an additional 10% from the owner.

As a Certified Development Company (CDC), LiftFund administers the SBA’s 504 loan program in Texas.

SBA 504 Loans

debenture:

debenture:

LiftFund can help small business owners acquire real estate and equipment they need to grow their businesses.

The SBA created the 504 loan program to help entrepreneurs finance commercial real estate and equipment for their businesses. As a Certified Development Company (CDC), LiftFund administers the SBA’s 504 loan program in Texas. Businesses use these loans to finance fixed asset acquisitions such as:

- Purchases of existing buildings

- Land purchases and improvements

- New facility construction

- Existing facility modernizations,

- renovations, and conversions

- Long-term machinery purchases

- Some furniture and fixtures

Some furniture and fixtures

Businesses in operation for 2 or more years can also use 504 loans to refinance existing debt that meets the following criteria:

- A non-federal loan

- Outstanding for 2 or more years

- Current on all payments for the last 12 months

- It was used originally (85% or more) to finance eligible 504 uses (see above)

The graph to the right shows how LiftFund partners with a participating lender (typically a bank) to finance part of the project. Most projects require a 50-40-10 split. However, businesses and/or projects considered “special purpose” require an additional 5% from the owner.

Apply Now for an SBA 504 loan.

Helpful tools and resources

Recent Projects

- Houston, Texas

Restaurant

Bank: $1,329,500

SBA: $930,650

Borrower: $398,850

Total: $2,659,000

504 Terms: 3.261% for 25 years

- San Antonio, Texas

Day Care

Bank: $2,030,800

SBA: $2,030,800

Borrower: $405,640

Total: $4,056,400

504 Terms: 3.032% for 25 years

- McAllen, Texas

Dental Office

Bank: $2,195,400

SBA: $1,756,320

Borrower: $439,089

Total: $4,390,800

504 Terms: 2.817% for 25 years